Acadia vendor called out for evictions as Tourism's Invisible Hand works its potion

OTHER NEWS: Restart of Hampden waste plant delayed to 2026; developer to reduce lots in 200-acre Town Hill project

BAR HARBOR, Nov. 10, 2023 -Acadia National Park may claim no moral high ground by posturing itself as a civic minded institution.

Town Council vice chair Gary Friedmann Tuesday night called out the park’s principal concessionaire for displacing residents at the former Compass Harbor apartments with its own seasonal workers, much like other tourism businesses which he also called out.

The eviction of year-round residents by summer businesses “is what’s killing the community,” Friedmann said of the vendor which operates Jordan Pond House and various gift stores in the park.

Friedmann told of a resident who contacted him and “was literally traumatized” after he lost his home. “They booted him out so that they may put seasonal employees there from May through October.”

“There was no place he could go. He couldn’t find anything which was affordable.

"I think that's what we want to address - employers looking for seasonal housing can just take these units, either one at a time or enmasse off the market to put their seasonal employees.”

His comments were part of a spirited discussion of employee seasonal housing and disagreement over its impact during the review of Planning Director Michele Gagnon’s “housing framework” strategies.

Besides Friedmann, members Matt Hochman, Maya Caines and Joe Minutolo spoke passionately about how tourism has quickly reshaped entire neighborhoods by gobbling up the housing stock for their seasonal needs.

Chair Val Peacock was her equivocal self. Member Kyle Shank was the lone wolf defending business interests. Member Earl Brechlin did not attend.

It was the first open acknowledgement by the council of a problem which has not gotten much public discourse, no doubt owing to the political influence of the powerful tourism sector.

On Nov. 18, the QSJ wrote that “employer-provided staff housing is the soft underbelly of the crisis on MDI.” It gets only a fraction of the attention of the short-term rentals fracas but could have a much bigger effect on the year-round housing stock.

A private equity firm based in Hermosa, California, with no particular allegiance to Bar Harbor, owns Acadia’s major concessionaire Dawnland LLC. According to Hancock County records, its subsidiary Orono LLC, has been buying up Compass Harbor apartments since 2020. Orono LLC has the same address as the private equity firm Nolan Capital, and lists its chairman Peter Nolan as its agent.

The company also holds short-term rental permits on 17 of the units since acquiring Compass Harbor, according to town records.

Friedmann cited other examples of exploitation of the housing stock:

The excavation of 18 families in the Ledgelawn Apartments in 2016 by the Witham Family hotel chain and the 2012 and the eviction of federally subsidized residents in 16 units in a low-income housing project on West Street Extension by Ocean Properties, which was the subject of a lawsuit.

That resonated with Hochman, who said he actually lived in the Ledgelawn Apartments.

"I lived there years ago and it was 16 families living there.” Hochman said he did not have a problem with the purchase. “It was on the market, they bought it.

“But that was 16 families who no longer can live there. I mean, that was a pretty big place to have lots of families, lots of kids there and losing stuff like that is is really hard on the community.

“What I really want to see from this is disincentivizing buying up residential properties to use for employee housing … anything we can do to encourage not buying up residential properties for employee housing.

“I don't know that anybody wants to come and build a 20-unit apartment complex now but but I do see a lot of four-to-six units being built. And whatever we can do to keep those in the hands of families rather than employee housing is what the goal is.”

No one has any idea of how many dwelling units on the island are being used for seasonal staff housing. Certainly not the town agencies.

Shank was the only supporter of the tourism interest (He and his wife were once employed by Side Street Cafe, whose manager Bo Jennings is now the board president of the local chamber of commerce).

“We need to be very smart about this and not turn this into a businesses buying houses is bad, because they have to house their employees,” Shank said.

“If we want to disincentivize it, what are we going to do with the college president’s house?” Shank said, referring to the College of the Atlantic.

He later clarified in an email, “With a presidential search underway, it isn't unreasonable to think that the college may have to purchase a residential property for the use of the President. I don't have any knowledge if that's actually the case or not, but I wanted to raise the possibility as an example of a use case that we, as a Council, should think through, especially in the context of the conversation around trying to prevent businesses/institutions from purchasing residential properties.”

That brought a quick retort from Friedmann who said the wholesale removal of apartments for families was nothing like housing a college president who, by the way, is not a seasonal employee.

Planning Director Michele Gagnon responded by posing whether the increase in seasonal employee housing “could help reduce the pressure on the year-round housing stock.”

In an interview after the meeting, she said the town needed to do a better job of distinguishing between seasonal employee and year-round employee housing of the type sought by Jackson Labs, College of the Atlantic and even her own department which has had a opening for a planner since last June because candidates cannot find housing.

It was the most intense council conversation about the housing crisis since August, when Hochman proposed a moratorium on new transit lodging development, saying the town no longer had the capacity to handle unfettered growth. The town’s major hotel operators responded by organizing a protest at a council meeting in October which packed the council chambers with their employees.

The council rescinded its moratorium proposal and chose instead to pursue a tourism management plan which has not appeared on any agenda since the new town manager started in mid November. The QSJ asked him and council chair Peacock on the status of that plan and got no response.

FOOTNOTE:

My friend Kurt Repanshek, who wrote the National Park Traveler, reported that Ortega National Parks LLC, former owner of the concessions in Acadia National Park, sold the company in 2019 three months after its president was quoted in the Islander as stating he had no plans to sell.

The private equity firm Nolan Capital Inc. became the principal owner of the concessions in Acadia National Park, Mammoth Cave National Park, Death Valley National Park, and several other units of the National Park System.

Repanshek reported that Ortega surprised many back in 2013 when the Santa Fe-based company took over running Acadia’s concessions, which grossed nearly $6 million annually, that had been handled by a Bar Harbor company for eight decades. At the time supporters of The Acadia Corp. mounted a petition drive to have Congress investigate how the 10-year contract was awarded.

“The Acadia Corp. argued unsuccessfully that Ortega made commitments beyond what the Park Service was seeking in the new concessions contract, was awarded points in the evaluation process for those commitments, but that the Park Service did not include those commitments in the eventual contract because they were either unfeasable to implement ‘or of no value’ to the agency,” Repanshek wrote.

“The Acadia Corp. also maintained that some of the contract requirements made upon Ortega couldn't be achieved because some of the menu items mentioned were either not obtainable or illegal in Maine and New England. In one instance, the company claims, Ortega proposed to ‘serve roe from a threatened or endangered fish,’ something contrary to sustainable practices and which indicates the review panel was ‘not competent to conduct an evaluation in this area.’’

The QSJ was not able to reach Peter Nolan for comment about the recent evictions.

Ocean Properties testing monthly rental concept

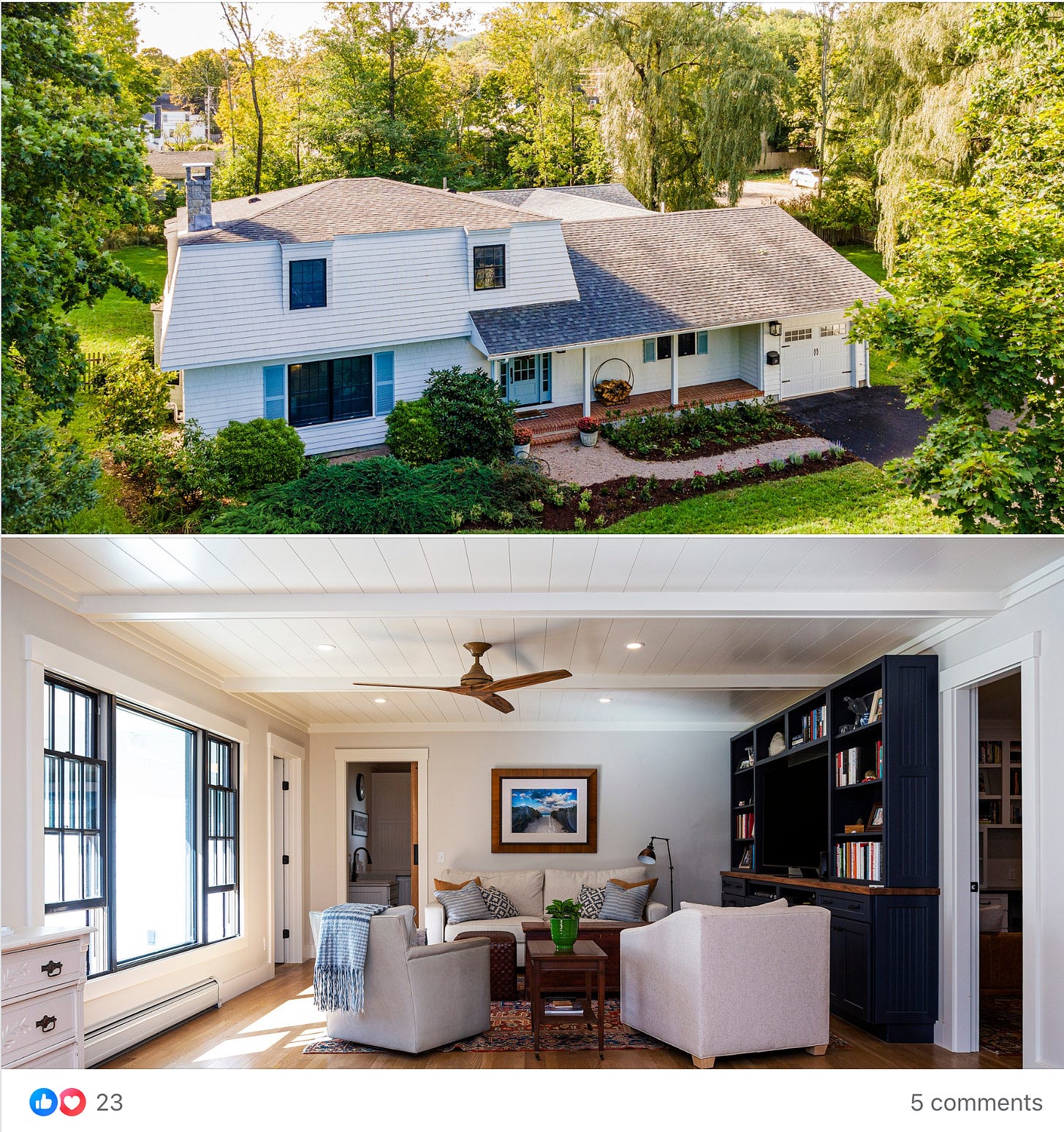

BAR HARBOR - For a cool $20,000, you may rent this house across from the historical society on West Street for one month, according to a posting on Facebook by Ocean Properties.

Owners are barred from renting their houses for fewer than 30 days under the town’s vacation rental ordinance adopted in 2021 which placed a cap on short-term rentals. About 645 owners have permits for STRs obtained before the cap.

The listing stated the following:

“Four bedrooms and four bathrooms, an office with space for a least two workers, a great room stocked with board games, a kitchen that was built with entertaining in mind – this is a house designed to accommodate groups of all different scores. Whether you’re a professional whose job has brought you to the Downeast region, a remote employee looking to leverage the magic of Mount Desert Island’s backdrop, a couple who fancies a secluded summer outpost to host visitors on the weekends, or a multi-generational family ready to make Maine summer vacation memories, The Willow House will accommodate with aplomb.”

There were these comments on FB:

Alden Strong Bet that used to be a great place for a year round family to live...

Rose Thatcher definitely a multimillion dollar home.. so any year round family that could buy that have plenty of options on the island

Peter Beckett Onlyl $20,000/month!

Amilie Blackman gross

David Paine Wow.

According to assessor’s records, the house at 128 West Street was purchased a year ago by Ocean Properties for $2.3 million from Cindy Launer, who bought it in 2019 for $1.125 million. The property is assessed at $1.64 million.

Major overhaul of Hampden waste plant delaying restart date to 2026

ORONO - The new owner of the regional waste disposal plant in Hampden is making a major technology retrofit which is likely to delay full commercial operation until late 2026.

Innovative Resource Recovery is abandoning the integrated pulper which the previous owner claimed was first recycling facility in the US to use one.

Instead, INN is installing an “anerobic digestion” process through which bacteria break down organic matter such as biosolids and food wastes, in the absence of oxygen. INN CEO James Condela said in an interview the process will result in high value renewable natural gas.

He described the transition at the annual meeting of the 115-town consortium, Municipal Review Committee, this week. The MRC sold the plant to INN for $3 million in July and INN is expecting to invest $35 to $40 million to restart the plant, which was closed in May 2020 when the previous owner ran out of operating cash.

“Our goal is that intense focus on the engineering and technology selection, as well as integration to the existing plan, with an eye toward issuing those purchase orders and have all the equipment in 2024,” Condela said.

He is hoping for partial operation to start in the winter of 2025.

“The goal is to ultimately arrive at 180,000-tons-per-year throughput capacity. But that will take time. You don't turn the switch and happens Day 1 … 2026 is a ramp year, getting us from that initial starting point to two-shift operations to get us where we need to be by the end of ‘26.”

How anerobic digestion works

MRC Board President Karen Fussell thanked Condela for his update. “We're super excited to have you work so hard on it. It's clear that you guys are earnest and forging ahead as fast as possible - not as fast as we would like.

“Realism is valuable too,” she said.

Landfills in Old Town and Norridgewok have been the primary waste disposal solutions in the region since the plant in Hampden and the incinerator in Orrington closed.

The new timeline will no doubt put additional stress on the landfills and potentially shorten their expected lifespan. The Bangor Daily News reported in October that the Old Town landfill was nearing a crisis.

The previous owner of the Hampden plant, Ultra Capital, invested $90 million using technology from Fiberight Corp. The plant opened in 2019 but operated only seven months before closing. The bondholders lost most of the money and the MRC forced the issue last year to acquire the assets which led to the selection of INN as the operator after two failed attempts. The MRC owns the land under the plant.

The original technology called for a pulper to reduce the waste after cardboard, plastics and other recyclables are first removed.

“The remaining mixture of trash and paper is treated with water and the paper breaks down into pulp,” the MRC stated on its website. “These can then be washed and put toward beneficial reuse such as renewable natural gas.”

That core technology is now part of the plant’s long, sordid history. All four towns on MDI are members of the MRC.

Developer plans to reduce units on 200-acre subdivision project in Town Hill

BAR HARBOR - Planning Director Michele Gagnon said Friday she is awaiting the applicant for the 14-lot subdivision on 200 acres off Crooked Road to submit a redesign which will have only four lots.

Gagnon said she expects the amended application will be for lots only on Crooked Road. The map below showed the original lots which would require the use of land in an area with significant wetlands.

The QSJ reported Nov. 11 that preservationists and naturalists were alarmed at the potential impact of the project on the Northeast Creek watershed.

It is not clear whether the four lots would be the just first phase of the project which originally was proposed to occur in four phases.

The applicant Brigadoon Acres LLC is owned by a Massachusetts couple, Christopher Bettencourt and Denise Carey Bettencourt, whose mother purchased the land in the Fifties.

The QSJ had incorrectly reported previously that the Bettencourts purchased the land for $1,520,200. That is the assessed value, not the purchase price.

Politico: How Leonard Leo used ‘plain historical falsehoods’ in briefs to inform court decisions

NORTHEAST HARBOR - Politico last week published what Esquire’s Charlie Pierce called a nifty analysis on how a small group of our neighbor Leonard Leo’s acolytes used centuries-old untruths in friends-of-the-court filings to influence decisions.

A POLITICO review indicates most conservative briefs in high-profile cases have links to a small cadre of activists aligned with Leonard Leo.

In his majority opinion, Justice Samuel Alito used the same quote from Henry de Bracton, the medieval English jurist, that George cited in his amicus brief to help demonstrate that “English cases dating all the way back to the 13th century corroborate the treatises’ statements that abortion was a crime.”

George, however, is not a historian. Major organizations representing historians strongly disagree with him.

That this questionable assertion is now enshrined in the court’s ruling is “a flawed and troubling precedent,” the Organization of American Historians, which represents 6,000 history scholars and experts, and the American Historical Association, the largest membership association of professional historians in the world, said in a statement. It is also a prime example of how a tight circle of conservative legal activists have built a highly effective thought chamber around the court’s conservative flank over the past decade.

Leo owns a home here which has been the center of weekly protests during the summer.

SWH gets its new Harbormaster office

SOUTHWEST HARBOR - Harbor Committee member Anne Napier forwarded these photos of the new office for the harbormaster which was the culmination of seven months of intense work by her from design to construction management.

This is not the first time Acadia Nat'l Park affiliated vendors have been involved in evicting long term year round residents. If I recall, an entire housing complex near Hadley Point Road was emptied when the St. Germaines sold renters' homes out from under them to Dawnland (which took over operation of Jordan Pond House from a local enterprise. )

The human wreckage of these real estate and business transactions are born by individuals and the community. As is the loss of year round small businesses. Small local entrepreneurs are put at a disadvantage to multi-business owners gobbling up real estate. It seems even worse when it is local people who own many businesses and much real estate acting as though business as usual must be governed by dog eat dog greed. It stifles the best of entrepreneurial innovation and limits opportunity.

It is wrong and impractical to consider real estate, particularly housing, as just another business run for profit making.